Interest will be charged to your account from the purchase date if the purchase balance is not paid in full within 6 months. May not be combined with any other credit promotion offer. With the Klarna app you can pay later with thousands of participating businesses on the app, with no automatic interest or fees for select users. Offer is valid for consumer accounts in good standing and is subject to change without notice. These days, on almost any online checkout page, you’ll find a sleek little icon beckoning you to split. But apps like Afterpay, Affirm, Quadpay and Klarna, which let shoppers pay for purchases in installments, have spread like wildfire during Covid-19, as the pandemic shrinks wallets and pushes shoppers online. Minimum interest charge: no less than $2. Buy now, pay later (BNPL) have been the golden words in fintech for years. As of, APR for purchases: Variable 29.99%. These apps allow shoppers to pay for their purchases in easy installments so which one should we choose Before we get into the Sezzle vs Quadpay debate, let’s have a look at each of them. ****With credit approval on all purchases totaling $150 or more on the American Airlines Credit Card. Luckily for us, finance apps like Quadpay and Sezzle have our back.

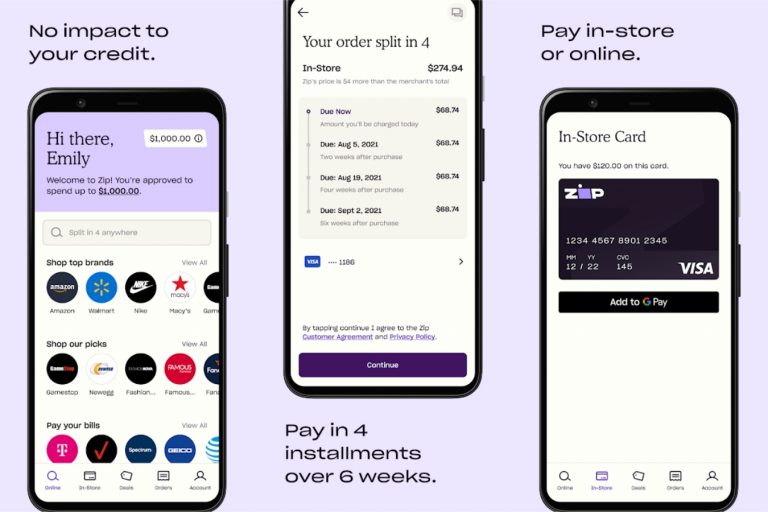

***Gift cards, eVouchers and Flight Discount are available in the U.S. 51 en Shopping 4,9 424,7 mil valoraciones Gratis Capturas de pantalla del iPhone Descripción Zip gives savvy shoppers more freedom and flexibility with our buy now, pay later platform. **Available in: Australia, Belgium, China, Denmark, Finland, France, Germany, Greece, Guadalupe, Hong Kong, India, Ireland, Israel, Italy, Japan, Korea, Martinique, Netherlands, New Zealand, Norway, Portugal, Russia, Spain, Sweden, Switzerland, UK and U.S.

0 kommentar(er)

0 kommentar(er)